how to find bull flag stocks

Take our 2 FREE candlesticks courses here. They are pretty rare outside of penny stocks which tend to be less reliable.

Are You Taking Advantage Of These 3 Bull Flag Patterns

When you see the graphical representation of this pattern youll notice that it.

. 1 day agoBut today it can be different. The price of the stock often surges 15 30 50 even 100 or more out of this pattern. A bull flag is a continuation chart pattern that signals the market is likely to move higher.

If a bar breaks above the counter-trendline but closes below it adjust the line to accommodate the break as the pullback continues. How to find stocks that are starting to form a Bull Flag pattern. What you will learn in this video.

The line will become shallower. Trading the bull flag pattern helps you spot continuations in price and capture large price swings with ease. A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends.

But today it can be different. Wait until you can identify a bull flag and price trends down to the average. You simply set the screener in Finviz to show stocks that are overbought RSI 60.

I dont want you just jumping into a bull flag when you think it has ended. Bull flags video breaks down how to locate a bull flag on stock charts. RUN IN STOCK SCREENER.

Before StocksToTrade I used thinkorswim to help scan for stocks. Moving average crossovers on. This scan looks for stocks Market Cap 0M ATRP 3 500k-1M 20 daily avg volume with a 50 SMA over the 100 and 200 and a pullback to the 20 EMA or 50 SMA support lines with a.

Today we talked about screening stocks and finding good bull flag patterns. Look for your trade entry at the conclusion of the bull flag and in the zone of previous price structure. Stay tuned for my 3 st.

When you couple them with moving averages like the 9 and 20 exponential moving averages you can have a pretty good formula for trading. And the rally needs high volume. 9 My Tips to Use This Strategy on Day Trades.

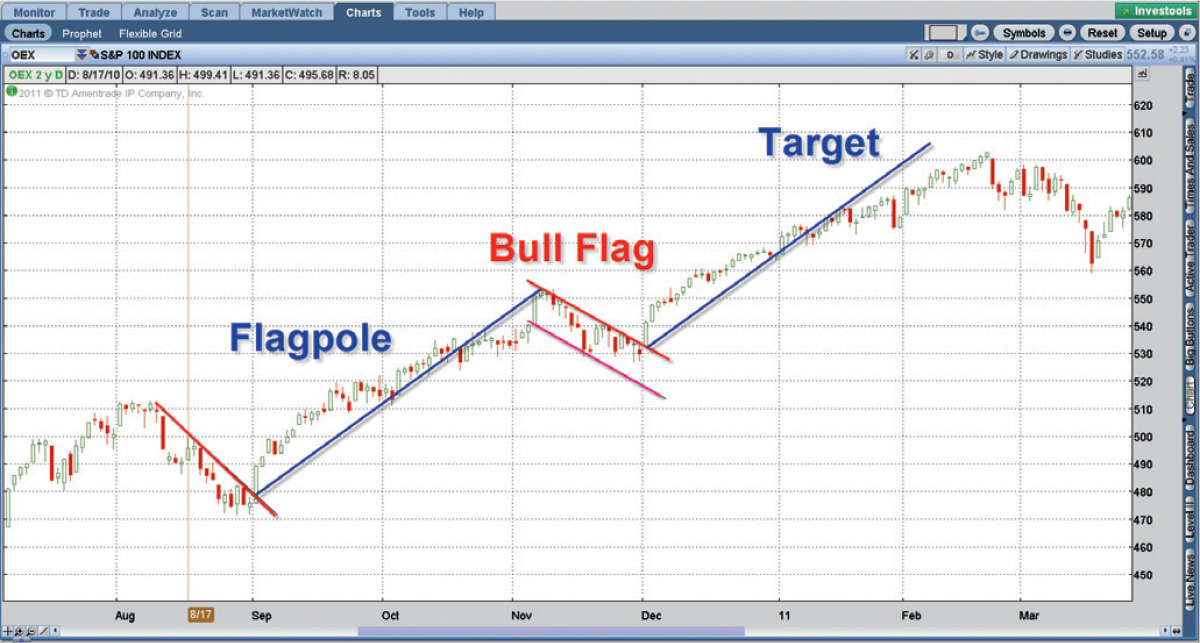

Preceding uptrend flag pole Identify downward sloping consolidation bull flag If. 93 Know the Importance of Using a Stop Loss. The flagpole forms on an almost vertical panic price drop as bulls get blindsided from the sellers then a bounce that has parallel upper and lower trendlines which form the flag.

Finding Bull Flag patterns is quite easy. Please enable JavaScript to continue using this application. This means the range of the candles are more bullish than usual and they tend to close near the highs.

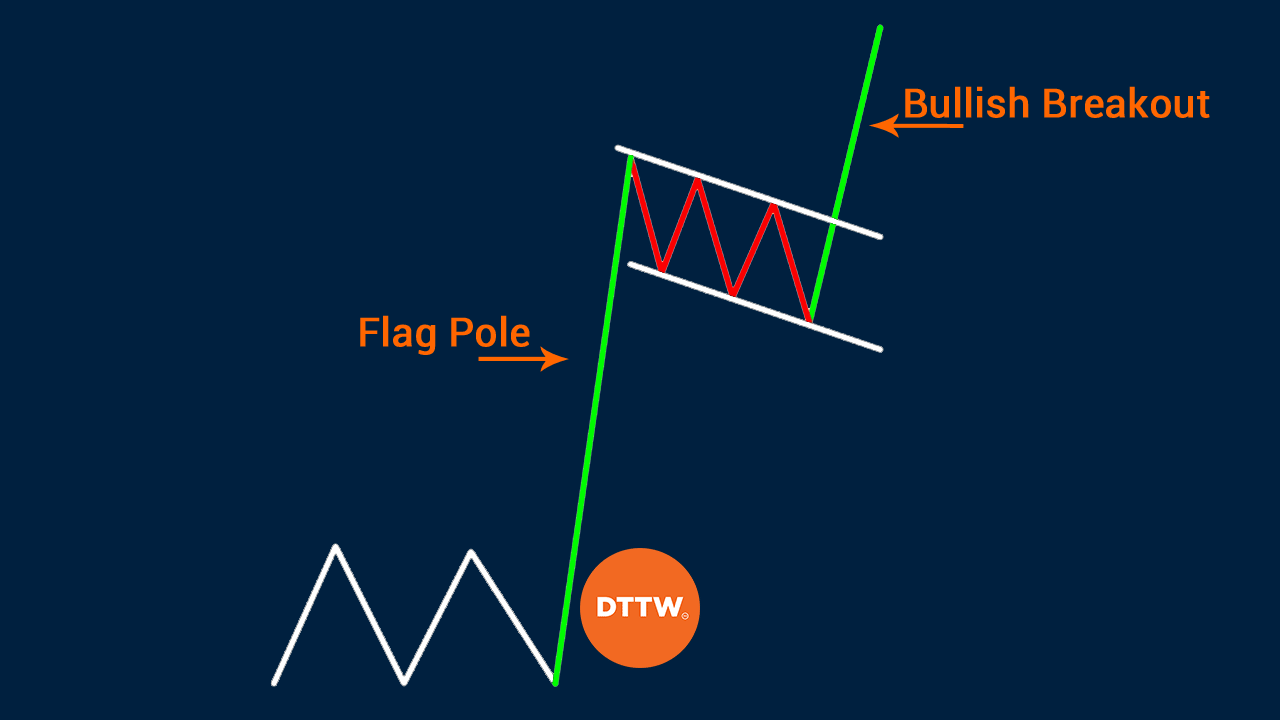

Buy when a candlestick closes above the counter-trendline. It consists of a strong rally followed by a small pullback and consolidation. You need some type of entry trigger to get you into any trade.

Have this so far but dont see whats wrong. It has the same structure as the bull flag but inverted. 94 Follow the Price Action.

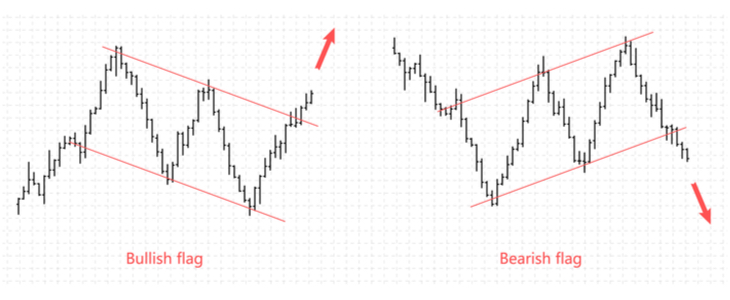

The bear flag is an upside down version of the bull flat. The bull flag is an easy-to-learn pattern that shows a lull of momentum after a big rally. A follow-up rally is likely when combined with other bullish indicators.

A search through the results will usually yield some potential Bull Flag patterns that are forming. 83 Bull Flag vs. Heres how to spot one.

Key things to look out for when trading the bull flag pattern are. Look for a strong trending move higher. Take a look at Stock Hacker on the Scan tab of the TD Ameritrade thinkorswim trading platform see figure 1.

692 This screen finds bull flag patterns. Usually its tough to enter into a fast-moving trade within a market but its easier to time the market with the bull flag chart pattern. 95 Master Your Skills with a Trading Mentor.

The pattern takes shape when the stock retraces by going sideways or by slowly declining after an initial big rise in price. What is the meaning of a Bull Flag Pattern and how does it work. We use this to confirm a bull flag breakout.

How to scan BULL FLAG breakouts on NSE stock Posted on April 9 2017 January 9 2019 by Stocks On Fire This strategy has recently gained momentum among the day trading community. Hey everyone what are your thoughts on this type of video. If the flag portion of the pattern develops a consistent downtrend its often called a bull pennant pattern because the flag has a triangular shape.

Breakout Scan can find stocks who broken previous swings high - low. Its screener has built in predefined function that can find stocks with Flags or Pennants. 91 Pay Attention to the Resistance.

92 Remember That Stocks Can Offer You a Second Entry Chance. 29 rows This happens when the 12-day EMA of the stock moves below the 26-day EMA. When I tested scan for bull flag pattern in stocks with average volume above 300K returned only five results as you can see below.

Bull flags can be found on any time frame you use for trading. A bull flag is a consolidation pattern after a strong move up.

A Market Signal Bull Flags Ascending Triangles And Ticker Tape

Flag Pattern Trading Learn The Basics Investment U

How To Trade Bull Flag Pattern Six Simple Steps

Bull Flag And Bear Flag Chart Patterns Explained

A Market Signal Bull Flags Ascending Triangles And Ticker Tape

Stock Charting Tips Leading The Charge With Bull Fla Ticker Tape

How To Trade Bull And Bear Flag Patterns Ig Us

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttw

Bullish Flag Chart Patterns Education Tradingview

How To Trade Bullish Flag Patterns

Bullish Flag Chart Patterns Education Tradingview

Bull Flags And Bear Flags And Pennants Chartmill Com

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

How To Trade Bull Flag Pattern Six Simple Steps

How To Trade Bullish Flag Patterns

Bull Flag Price Action Trading Strategy Guide 2022